When a Company Creates Overhead Rates

The job cost sheet for Job 420 listed 4000 in direct materials cost and 5000 in direct labor cost to manufacture 7500 units. A companys overhead costs depend on the nature of the business.

Annual Photography Business Overhead Expenses Photography Buisness Photography Business Photography Marketing

The above rates are to be used as the Overhead Factor in calculating ABottom Line Overhead figures and Fixed or Net Fee for each type of work.

. A retailers expenses will be different from a repair shop or a crafters. Heres how to figure per-unit price with those numbers. It also scales it by company gross revenues and gross assets so youve got small medium and large firms who.

The company could also establish its overhead. A good rule of thumb is 10 overhead with 10 profit. The overhead rate is.

Your overhead rate is 123 or about 12 cents overhead for every dollar earned. The definition of overhead cost with examples. Rent is payable monthly quarterly or annually as agreed in the tenant agreement with the landlord.

It helps the company decide what role the rate plays in the prices of the product. This easy-to-use monthly expenses template and spreadsheet will help. To calculate the overhead rate divide the indirect costs by the direct costs and multiply by 100.

For example if you have a 25 overhead rate this means that your company invests 25 cents in overhead for every dollar that you make. If you make 13000 in sales in a typical month and you spend 1600 on overhead you get the following calculation. Per-Unit Price 58.

Unless youre a very small like one-person small outfit tackling small renovations there are important and expensive costs left out of that equation. Once youve figured out your monthly sales you can calculate your overhead ratio with the following equation. Calculating the overhead rate can be done by dividing the indirect costs by the direct costs and multiply by 100.

Company As overhead percentage would be 120000 divided by 800000 which gives you 015. Per-Unit Price 2000 250 50. Overhead Cost Sales Overhead Rate.

Overhead rate 4 or 205 meaning that it costs the company 4 in overhead costs for every dollar in direct labor expenses. It is advised for the companies to review their overhead costs bi-monthly monthly and quarterly by doing regular bookkeeping. Multiply that by 100 and your overhead percentage is 15 of your sales.

However if you are an information technology company that offers revenue generating IT services technology costs may not be overhead. If the property is purchased then the business will book depreciation expense. Jones Company uses a job-order costing system with a predetermined overhead rate of 120 of direct labor cost.

Overhead rates can be calculated by using the cost allocation method for each cost center category. For example many businesses consider information technology as an overhead cost. A lower overhead rate.

Divide the total job cost by the number of units produced. Answer 1 of 3. For some companies calculating overhead consists of materials tools vehicle costs travel insurance and the cost of shop rent or mortgage.

The overhead rate sometimes called the standard overhead rate is the cost a business allocates to production to get a more complete picture of product and service costs. Monthly Overhead Expenses 1 Month Worksheet Excel. In order to cover the cost of overhead in the price you charge for your product assuming you sell at least 250 units.

These rates will remain in effect until officially replaced. Enter only one word per blank. For the formula to work you need to use numbers from a single period like one month.

Monthly Overhead Monthly Sales x 100 Percentage of Overhead Cost to Sales You can also measure your overhead costs compared to your labor costs. Cost per Hour The overhead rate can also be expressed in. A lower overhead rate shows efficiency and higher profits.

Rent Utilities Insurance Salaries that arent job- or product-specific Office equipment such as computers or telephones Office supplies Types of Overhead Costs. Overhead rates refer to that percentage of direct costs that enable assigning overhead costs to the respective cost object. April 26 2017.

Rent and utilities employees and payroll taxes phone and Internet vehicles marketing professional fees supplies and materials bank and credit card charges travel expenses and more. This means that at Company A for every dollar the company makes 15 cents goes to pay overhead. Per-Unit Price 8 50.

If the company uses machine hours as its allocation measure then its overhead rate for the year would be 5875 per machine hour. When a company creates overhead rates based on the actions it performs it is employing an approach called 1 - 2 costing. Sure the Risk Management Association publishes an annual book compiling thousands of businesses financial statements into relevant percentages of sales such as overhead.

If your overhead rate is 20 it means the business spends 20 of its revenue on producing a good or providing services. It is determined on the basis of the causation principle. Rent Rent is the cost that a business pays for using its business premises.

Overhead costs depend on your business model. The appropriate overhead rate is industry-specific so you should take some time to research what the standard is for businesses in your region. In order to calculate your overhead rate youll use the following formula.

These different cost treatment methodologies can affect the competitive cost position of the company and must be taken into account when evaluating the companys overhead rate. The most common overhead costs that any business incur include. October 2010 How do you calculate overhead rates for an entity with a single federal contract for a start-up state-created regional authority.

1600 13000 0123. Once a company calculates the overhead rate and percentage it comprehends the effect of overhead on various costs involved in a business. Overhead Costs Sales Overhead Rate In this example lets say that you had 32000 in.

If your overhead rate is 40 it implies the enterprise spends 40 of its income on making a good or providing a service. Also known as fixed costs monthly overhead expenses include.

Crowdsourcing Vs Outsourcing Outsourcing Collaborative Economy Startup Funding

Planning For Business Growth Business Growth Small Business Advice Business

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Need To Manage Your Home Based Repair Business You Need This Handyman Business Management Google Spre Handyman Business Business Management Pricing Calculator

How To Calculate Cost Of Manufacturing Apparel Products Online Clothing Study Manufacturing Budgeting Worksheets Cost

Product Assessment Report Template Free Report Templates Sales Report Template Report Template Report Writing

Cake Decorating Home Bakery Business Management By Expressexcel Home Bakery Business Bakery Business Home Bakery

The Definitive Guide To Crowdsourced Testing For Companies And Testers Infographic Social Media Infographic Outsourcing

How Do Total Cost Of Ownership Models Affect Your Business Group50 Com Business Analysis Business Process Management Process Improvement

4 Reasons Why Business Need Data Processing Solutions Data Processing Data Data Services

Tips Ventas Tips Ventas Small Business Plan Small Business Success Business Planning

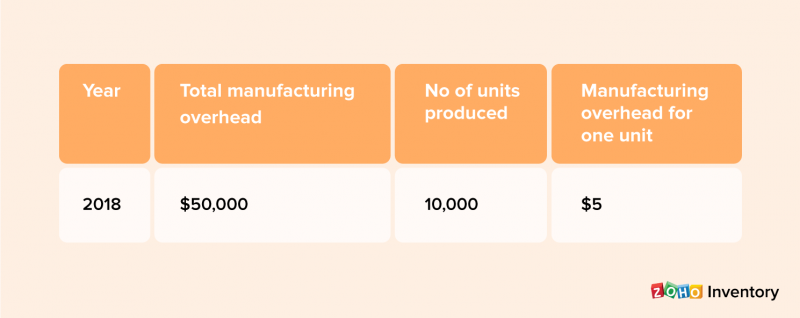

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Business Case Template Word Business Case Template Business Case Make Business

Pricing Your Home Baking Can Be Easy Learn How To Be Confident Not Awkward In Pricing Your Home Baked Go Pricing Calculator Bakery Business Plan Home Bakery

How To Create An Outdoor Living Space Infographic Home Improvement How To Outdoor Living Space Outdoor Living Outdoor

Pin By Stephen On My Saves Marketing Strategy First Page Marketing

Home Cake Decorating Bakery Business Management Excel Spreadsheet Cakeboss Cakedecorating Recipe Busin Bakery Business Cookie Business Home Bakery Business

Comments

Post a Comment